What the Budget Delivered

- No changes to Stamp Duty - after weeks of expectation, the Budget made no alteration to Stamp Duty Land Tax (SDLT).

- Introduction of a new “mansion tax” - a high-value surcharge will apply to homes worth over £2 million, via a new “High Value Council Tax Surcharge”. Only a small proportion of homes (mostly high-end) will be affected.

- Higher tax rates on rental/property income for landlords - from April 2027 property income tax rates go up by 2 percentage points. The new bands: basic rate 22%, higher rate 42%, additional rate 47%.

- Relief order change for investment income - from 2027, any allowances or reliefs (e.g. personal allowance) will first be applied against “standard” income (employment, pension, etc.), and only then against rental, dividend or savings income. This means many landlords and investors will see tax bills rise.

In short, the Budget left the traditional homeowner market (especially mid-range homes) largely untouched, but made life harder for landlords and people with high-value homes.

What the Budget Did Not Do (and Why That Matters for Hale and Manchester)

The pre-Budget speculation around stamp duty reform, new bands/surcharges for high-value homes and landlord tax changes was mostly correct, but only the last came to pass (and the surcharge on high-value homes came via council tax, not stamp duty).

What did not happen:

- No overhaul or scrapping of stamp duty. This means upfront purchase costs remain unchanged, so for many buyers the barrier to entry hasn’t changed.

- No broader tax changes on “mid-market” owner-occupiers - no new levy for £300k–£600k homes, no mass “mansion tax” hitting the middle class, and no sudden price panic for “ordinary” homeowners.

Implication for Hale & Manchester “core market”:

- Buyers and sellers in the £300k–£600k range remain in familiar territory. Since no extra tax shock landed, demand may hold, especially for well-priced, turnkey homes.

- The “wait-and-see” approach taken before the Budget may ease slightly now; with clarity on tax policy, some buyers may re-engage.

What This Means for Landlords & the Rental Market

Given the changes, landlords, especially those in areas like Hale, Altrincham or other Manchester suburbs, are likely to feel pressure. Specifically:

- Rental income will be taxed more heavily (from 2027). Many small-scale or mortgage-backed landlords may find net yield compressed.

- The change in tax relief ordering means that allowances are less beneficial for rental/savings/dividend income. This further reduces after-tax yield.

- As profit margins shrink, some landlords may consider selling, which could reduce rental supply.

Given the recent introduction of Renters' Rights Act 2025 (which tightens tenant protections) this adds further compliance costs/uncertainty for landlords.

What It Means for High-Value Homeowners (e.g. £2 M+ Homes)

The introduction of the “mansion tax” surcharge, payable via council tax from 2028 for properties above £2 million, likely affects only a small fraction of homes.

For the vast majority of readers in Hale / Manchester, this may not impose an immediate impact, but it does send a signal:

- For sellers of “executive-class” homes, buyers may be more cost-conscious. Some may attempt to price just below the £2 M threshold to avoid the surcharge (i.e. “price bunching”).

- If demand softens for ultra-prime homes, there may be downward pressure on asking prices at the top end.

- For those holding onto these homes, the surcharge means higher ongoing costs, some may consider selling rather than carry the burden.

Given that such high-value properties are a lower share of the overall market in Greater Manchester than London, the overall direct impact locally is likely modest. But it could shape sentiment in the “upper-end” segment, and influence how local agents price top-tier homes.

Advice for Our Clients & Readers in Hale and Manchester

Given the new landscape post-Budget, here’s what you, as buyer, seller, landlord or investor, should consider:

- If you’re a buyer (owner-occupier): So long as your purchase is mid-market (e.g. £300k–£600k), tax costs remain largely as before, making now a sensible time to re-engage with the market.

- If you’re selling a mid-market home: Because no stamp duty shock landed, well-priced turnkey homes should continue to attract demand. It may be a good time to list, especially before mortgage costs or interest rates shift again.

- If you’re a landlord: Revisit your cashflow and yield forecasts in light of higher future tax on rental income. If net returns fall below acceptable thresholds, consider selling, capital reallocation, or shifting property into more tax-efficient ownership.

- If you own a high-value home (£2 M+): Factor the surcharge into your holding costs or potential sale decisions. For sellers, consider timing and pricing to avoid the threshold if possible.

How Bentley Hurst Can Help

At Bentley Hurst, we’re here to guide you through every stage of your property journey, whether you’re buying, selling or investing.

With teams based in both Manchester and Hale, we understand the intricacies of each micro-market and can provide tailored advice based on our local insight.

If you’d like a free property valuation in Manchester or Hale, or simply want to discuss your next move, our experienced team is ready to help.

Need a property valuation?

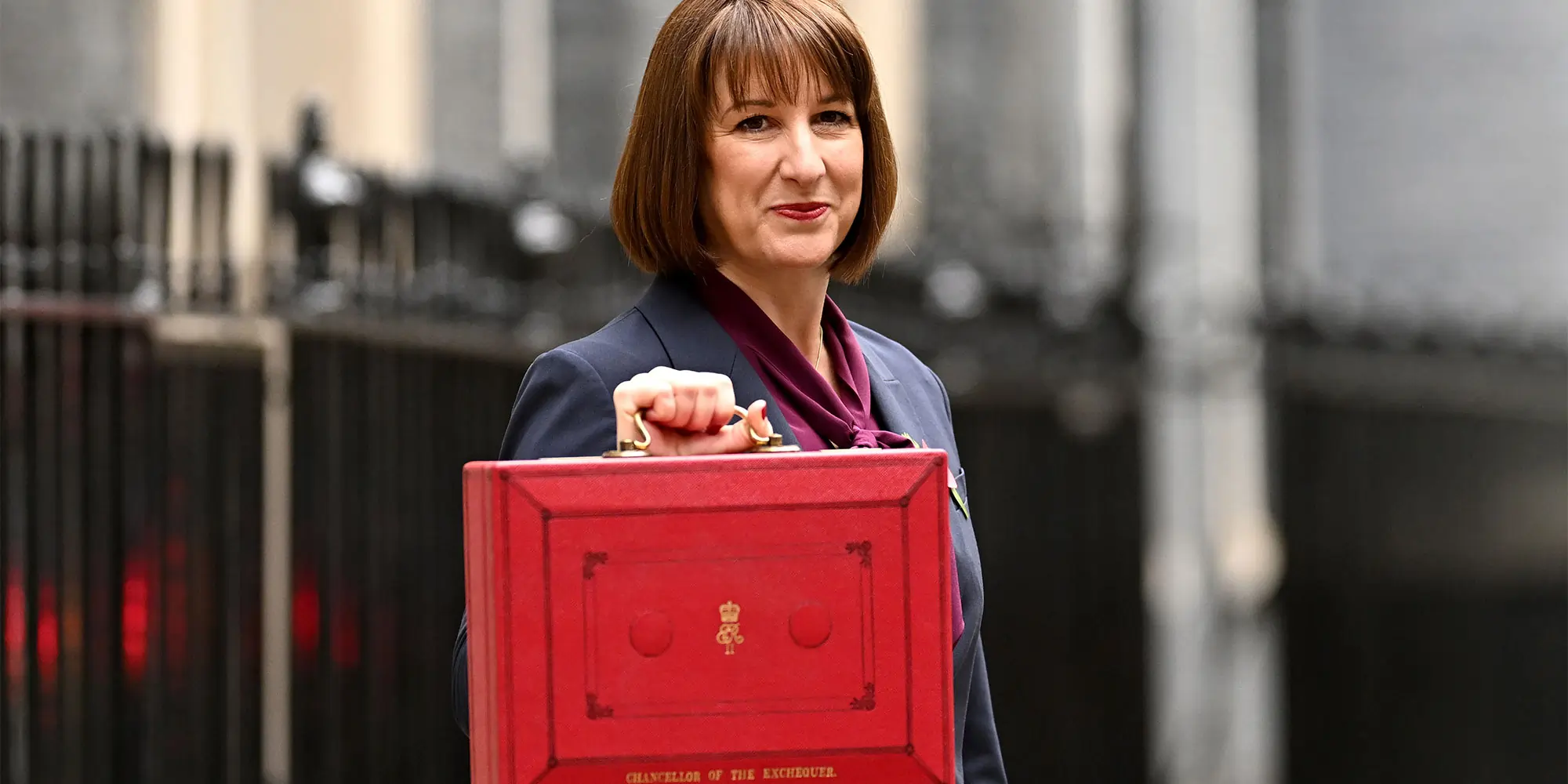

Managing Director

0792 327 4174